Market Outlook 2025: Steering markets normalisation

In recent years, financial markets have come through turbulent waters due to unprecedented challenges: negative interest rates in the Eurozone; a global pandemic and the resulting supply chain disruption; finally, a severe inflationary shock. The global economy was beset with uncertainty at every turn and, in response, policymakers had to take emergency measures and proceed with extreme caution.

Now, however, the clouds are beginning to clear. Economies and markets are returning to normal, and investment opportunities are taking a more definite shape. We are now entering a scenario in which strategic decisions based on economic fundamentals will make sense again. The outlook for global growth in 2025 - which we believe will be close to 3% - inspires renewed confidence.

Moreover, inflation is on the wane. As central banks approach their targets, they will be able to loosen monetary policy. Against a background of stable growth, this environment could prove ideal for investment in risk assets such as equities and debt, where the benefits of carry trades and duration are combined. Diversification will be critical to maximizing returns and managing risk: each portfolio must be tailored to the specific investor.

Investment opportunities

Our central scenario expects positive medium-term returns across all global assets and favors equities and credit.

Looking ahead to 2025, we expect the global economy to continue its return to normal in terms of growth, inflation and monetary policy. However, each of these variables will improve at its own pace.

Watch our live conference

Key ideas for 2025

1. U.S. equities

Stabilized growth coupled with inflation on track to Fed’s targets, favors the continuation of monetary policy normalization. This, combined with positive corporate earnings estimates, reinforces our conviction for U.S. equities as the main driver of a diversified portfolio. In addition, we believe that technology companies will continue to capitalize on AI investment, while other companies will also take advantage of the extended economic cycle to contribute to earnings growth, widening market breadth.

2. Eurozone and UK corporate bonds

A positive, albeit moderate, growth environment in Europe and a normalization of inflation and monetary policies make corporate bonds attractive. Increasing portfolio duration and betting on positive carry offers value, supported by confidence in the health of the corporate sector as reflected in the credit spreads.

3. Latam Fixed Income

The degree of monetary normalization varies by geography.

-

Brazil

The central bank has resumed monetary tightening. We maintain a positive view on monetary assets.

-

Mexico

We favor duration extension in long-term government bonds.

-

Chile

We believe corporates and government bonds will be favored by the attractive entry point offered by current rates.

-

Argentina

Sovereign bonds in USD remain an attractive opportunity for 2025.

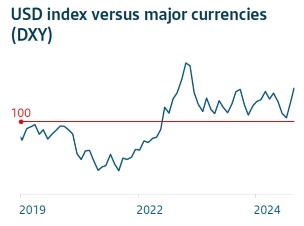

4. U.S. Dollar

In an environment of potential geopolitical risks, coupled with a more protectionist bias in U.S. policies, we continue to have a positive view on the dollar.

5. Generative AI 2.0 - Broadening investment to the whole ecosystem

Looking to the future, Generative AI 2.0 has become a key catalyst for growth because of its ability to transform industries and redefine productivity. According to McKinsey (1), the impact of generative AI could add trillions of dollars to the global economy. To identify those industries, and companies, in which the activities that are most enriched by generative AI have the greatest weight is to identify those that may have the greatest potential to boost their profits and contribute to economic growth. McKinsey’s most recent projections (1) indicate a significant impact in the following sectors:

(1) MckKinsey & Company. The economic potential of generative AI: The next productivity frontier. June 2023

High-Tech

Revenue could increase by 4.8% to 9.3% (240 billion to 460 billion USD).

Banking, Pharmaceuticals and Medical products

These industries are poised to benefit from increased operational efficiency and innovation and their revenue could increase by up to 4%.

Education

Enhanced personalized learning solutions and content creation are expected to drive growth, with the sector increasing revenue by more than 2%.

Structural trend in asset management: Private markets

The integration of private markets into portfolios strengthens the risk-return trade-off, offering a competitive advantage to our clients. The democratization of these assets, driven by financial innovation, a more accessible regulatory framework, greater transparency and financial education, is extending their reach beyond the institutional sphere to a more diverse investor base.

Within private markets, our preference is for private real estate as an asset with duration and recurring income, which in a normalized interest rate environment should benefit. Within the real estate sector, we particularly favor the co-living segment. This model, which maximizes income with low operating costs, is ideal for young people and digital nomads in high-cost cities.

In 2025, navigating the return to normal will require focus and the ability to adapt swiftly to change, but, for investors who are able to see and grasp the opportunities this new chapter will offer, the future is bright.

What will 2025 bring?

Discover our key messages and possible investment strategies to follow

This report has been prepared by Santander Asset Management (hereinafter “SAM”). SAM is the functional name of the asset management business conducted by the legal entity SAM Investment Holdings S.L. and its branches, subsidiaries and representative offices. This document contains economic forecasts and information gathered from several sources. The information contained in this document may have also been gathered from third parties. All these sources are believed to be reliable, although the accuracy, completeness or update of this information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this document may not be considered as irrefutable and could differ or be, in any way, inconsistent or contrary to opinions expressed, either verbally or in writing, advices, or investment decisions taken by other areas of SAM. This report is not intended to be and should not be construed in relation to a specific investment objective. This report is published solely for informational purposes. This report does not constitute an investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other type of contracts, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services. SAM makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors. Except as otherwise expressly provided for in the legal documents of a specific Financial Assets, the Investment Products are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk, and possible loss of the principal invested. In connection with the Financial Advisors, investors are recommended to consult their financial, legal, tax and other advisers as such investors deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, their respective directors, officers, attorneys, employees or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this report. Past performance does not predict future returns. The returns may increase or decrease as a result of currency fluctuations relative to the respective investors’ domestic currency. Any reference to taxation should be understood as depending on the personal circumstances of each investor and which may change in the future. Costs incurred for purchasing, holding or selling Financial Assets may reduce returns and are not reflected in this report. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained therein be referred to without, in each case, the prior written consent of SAM. Any third-party material (including logos, and trademarks), whether literary (articles/ studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report is registered in the name of its respective owner and only reproduced in accordance with honest industry and commercial practices.