High-Tech

Revenue could increase by 4.8% to 9.3% (240 billion to 460 billion USD).

Market Outlook 2025: Steering markets normalisation

In recent years, financial markets have come through turbulent waters due to unprecedented challenges: negative interest rates in the Eurozone; a global pandemic and the resulting supply chain disruption; finally, a severe inflationary shock. The global economy was beset with uncertainty at every turn and, in response, policymakers had to take emergency measures and proceed with extreme caution.

Now, however, the clouds are beginning to clear. Economies and markets are returning to normal, and investment opportunities are taking a more definite shape. We are now entering a scenario in which strategic decisions based on economic fundamentals will make sense again. The outlook for global growth in 2025 - which we believe will be close to 3% - inspires renewed confidence.

Moreover, inflation is on the wane. As central banks approach their targets, they will be able to loosen monetary policy. Against a background of stable growth, this environment could prove ideal for investment in risk assets such as equities and debt, where the benefits of carry trades and duration are combined. Diversification will be critical to maximizing returns and managing risk: each portfolio must be tailored to the specific investor.

Investment opportunities

Our central scenario expects positive medium-term returns across all global assets and favors equities and credit.

Looking ahead to 2025, we expect the global economy to continue its return to normal in terms of growth, inflation and monetary policy. However, each of these variables will improve at its own pace.

Key ideas for 2025

1. U.S. equities

Stabilized growth coupled with inflation on track to Fed’s targets, favors the continuation of monetary policy normalization. This, combined with positive corporate earnings estimates, reinforces our conviction for U.S. equities as the main driver of a diversified portfolio. In addition, we believe that technology companies will continue to capitalize on AI investment, while other companies will also take advantage of the extended economic cycle to contribute to earnings growth, widening market breadth.

2. Eurozone and UK corporate bonds

A positive, albeit moderate, growth environment in Europe and a normalization of inflation and monetary policies make corporate bonds attractive. Increasing portfolio duration and betting on positive carry offers value, supported by confidence in the health of the corporate sector as reflected in the credit spreads.

3. Latam Fixed Income

The degree of monetary normalization varies by geography.

Brazil

The central bank has resumed monetary tightening. We maintain a positive view on monetary assets.

Mexico

We favor duration extension in long-term government bonds.

Chile

We believe corporates and government bonds will be favored by the attractive entry point offered by current rates.

Argentina

Sovereign bonds in USD remain an attractive opportunity for 2025.

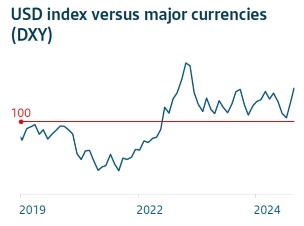

4. U.S. Dollar

In an environment of potential geopolitical risks, coupled with a more protectionist bias in U.S. policies, we continue to have a positive view on the dollar.

5. Generative AI 2.0 - Broadening investment to the whole ecosystem

Looking to the future, Generative AI 2.0 has become a key catalyst for growth because of its ability to transform industries and redefine productivity. According to McKinsey (1), the impact of generative AI could add trillions of dollars to the global economy. To identify those industries, and companies, in which the activities that are most enriched by generative AI have the greatest weight is to identify those that may have the greatest potential to boost their profits and contribute to economic growth. McKinsey’s most recent projections (1) indicate a significant impact in the following sectors:

(1) MckKinsey & Company. The economic potential of generative AI: The next productivity frontier. June 2023

Revenue could increase by 4.8% to 9.3% (240 billion to 460 billion USD).

These industries are poised to benefit from increased operational efficiency and innovation and their revenue could increase by up to 4%.

Enhanced personalized learning solutions and content creation are expected to drive growth, with the sector increasing revenue by more than 2%.

In 2025, navigating the return to normal will require focus and the ability to adapt swiftly to change, but, for investors who are able to see and grasp the opportunities this new chapter will offer, the future is bright.

What will 2025 bring?

Discover our key messages and possible investment strategies to follow